As these securities are highly liquid, they can easily be converted into cash. There is no actual definition of what counts as a short amount of time, but it is generally accepted that anything less than a year is serviceable. It’s also important that marketable securities have a strong secondary market. This means that you can quickly facilitate buy and sell transactions.

The Quick Ratio

It reveals how well a company can meet its debt and other obligations, and can be used to make comparisons between peers. The above two features can be used to classify any security as marketable securities. Marketable securities can be found in the balance sheet section of a company’s annual report. Here is a snapshot from the 2017 Annual Report of The Coca Cola Company.

Current Ratio

The exception is that liquidity means the time in which a security can be converted into cash. Whereas marketability is the ease at which the security can be bought and sold. The safest types of marketable securities are typically those that are issued by governments or government agencies. Where marketable securities are highly liquid and easily converted into cash, non-marketable securities are the exact opposite. Marketable securities are short-term assets that can easily be sold if a company needs to raise funds quickly. The cash flow statement would show the changes in the fair market value of the investments as a reconciling item in the operating section of the statement.

Lower Return

Examples of secondary markets are the New York Stock Exchange and Nasdaq. Marketable securities are also denoted under shareholder’s equity on the balance sheet as unrealized proceeds. They are unrealized because they have not been sold as yet so their value can still change.

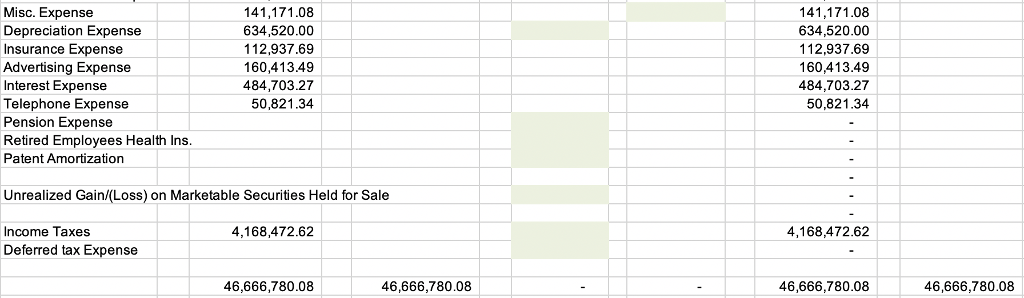

Any change will result in the unrealized gain/loss record in the income statement. They have included both debt securities and equity securities which are listed in the capital market. These companies what is payback period issue securities to raise funds to expand the business. Not only the company but the government also issue financial instruments to raise funds to support expenditure and public projects.

- Unfortunately, these companies will not have amazing ideas to plug the cash into a space to create outstanding returns.

- Prudential lists on the income statement as net investment income, such as below.

- One of the principal characteristics of marketable securities is that they are financial instruments that provide you the potential for financial return.

- Conversely, if the company expects to hold the stock for longer than one year, it will list the equity as a non-current asset.

- Marketable securities are crucial in managing liquidity and short-term investments in corporate finance.

Okay, there is much more to unpack from the above balance sheet snapshot. Next, let’s look at a balance sheet and try to understand how to locate and decipher what we see. It is always important for businesses to have a sufficient amount of cash at hand. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. In order to understand how discount and return are calculated, let us look at the illustration below.

Marketable securities are crucial in managing liquidity and short-term investments in corporate finance. These assets appear on the balance sheet as current assets because of their high liquidity and the expectation that they can or will be converted to cash within a year. Debt securities are the short-term debt bond that will be matured in less than a year. They represent the debt that issuers need to pay back to investors (holders) on the maturity date. The issuers have obligation to pay both principal and interest based on the bond term. The investors can wait until the maturity date or sell the instrument to the public market to immediately cash out.

The most reliable liquid securities fall in the money market category. Most money market securities act as short-term bonds and are purchased in vast quantities by large financial entities. These include Treasury bills, banker’s acceptances, purchase agreements, and commercial paper. In return, the shareholder receives voting rights and periodic dividends based on the company’s profitability. The value of a company’s stock can fluctuate wildly depending on the industry and the individual business in question, so investing in the stock market can be a risky move. Liquidity ratios determine a company’s ability to meet short-term obligations, evaluating whether it has enough liquid assets to pay off short-term liabilities.

This can help to reduce specific investment risks in addition to offering the potential for attractive returns. Companies and investors hold marketable securities instead of cash to potentially increase its net assets. However, marketable securities run the risk of losing initial investment capital.

And if you have a secondary market, it provides a much more accurate price for investors. Many types of marketable securities are readily accessible to individual investors including stocks, bonds, mutual funds, and ETFs. This makes it easy for investors to buy any of the securities mentioned above, as there are usually minimal limitations outside of a simple brokerage account needed to get started. There are numerous types of marketable securities, but stocks are the most common type of equity. They are also used in several liquidity ratios, including the cash ratio, current ratio, and quick ratio. These are used to provide insights into a company’s ability to cover its short-term obligations, which is an important consideration when evaluating a company.

First, the company has far more investments than Microsoft, and as an insurance company, Prudential invests in various different-length assets to match the insurance premiums they collect. They earn better returns than savings accounts but are as liquid as savings accounts. As the need for quick cash arises, the company can liquidate its short-term securities to fund that need. Most companies hold excess cash as a reserve if needed quickly, such as a possible acquisition or making debt payments if cash flow dries up.

No comment yet, add your voice below!