This means the cost of production to make one shirt is at $10 in your normal production capacity. This way, companies develop a realistic production roadmap, with an exact number of goods https://www.bookstime.com/ to be produced and the pricing per unit, to achieve profit goals in a business quarter. Also called marginal analysis, the relevant cost approach, or differential analysis, incremental analysis disregards any sunk cost (past cost). The basic method of allocation of incremental cost in economics is to assign a primary user and the additional or incremental user of the total cost.

What is an Incremental Cost?

- For example, when the 2,000 additional units are manufactured most fixed costs will not change in total although a few fixed costs could increase.

- In each of these scenarios, incremental costing provides a structured approach to decision-making.

- Relevant costs (also called incremental costs) are incurred only when a particular activity has been initiated or increased.

- Sunk costs are costs that have already been incurred and cannot be recovered, regardless of the decision made.

- Suppose the retail chain estimates that the online platform will generate an additional $100,000 in annual revenue.

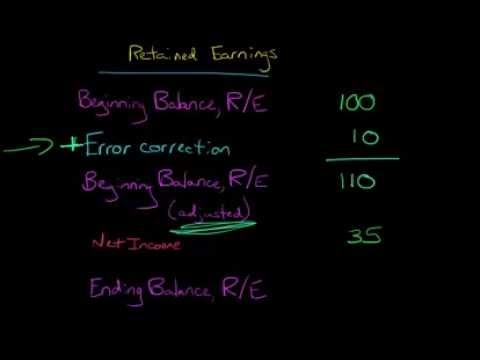

For instance, a company merger might reduce overall costs of because only one group of management is required to run the company. Producing the products, however, might bring incremental costs because of the downsizing. The management must look at the additional cost of producing the products under one incremental cost roof. This could mean more deliveries from vendors or even more training costs for employees. Assuming a manufacturing company, ABC Ltd. has a production unit where the cost incurred in making 100 units of a product X is ₹ 2,000.

Limitations of Incremental Costing

By carefully considering all relevant aspects and using appropriate analytical tools, you can make well-informed decisions that align with your objectives. Remember, identifying https://www.instagram.com/bookstime_inc relevant costs requires a holistic approach, considering both short-term and long-term implications. By mastering this skill, decision-makers can make informed choices that maximize value and drive success.

- The bill would allow the county to consider temporarily suspending future increases to the minimum wage if there’s negative employment growth in the region.

- Incremental costs change at different scales of production, and so do their benefits.

- Incremental cost is the difference between the total expenditures required to produce a given number of units and the total expenditures a business incurs to produce those units plus one.

- The tobacco business has seen the significant benefits of the economies of scale in Case 3.

- In this section, we will delve into the intricacies of comparing benefits and costs, providing insights from various perspectives.

The Difference Between Cost vs. Price

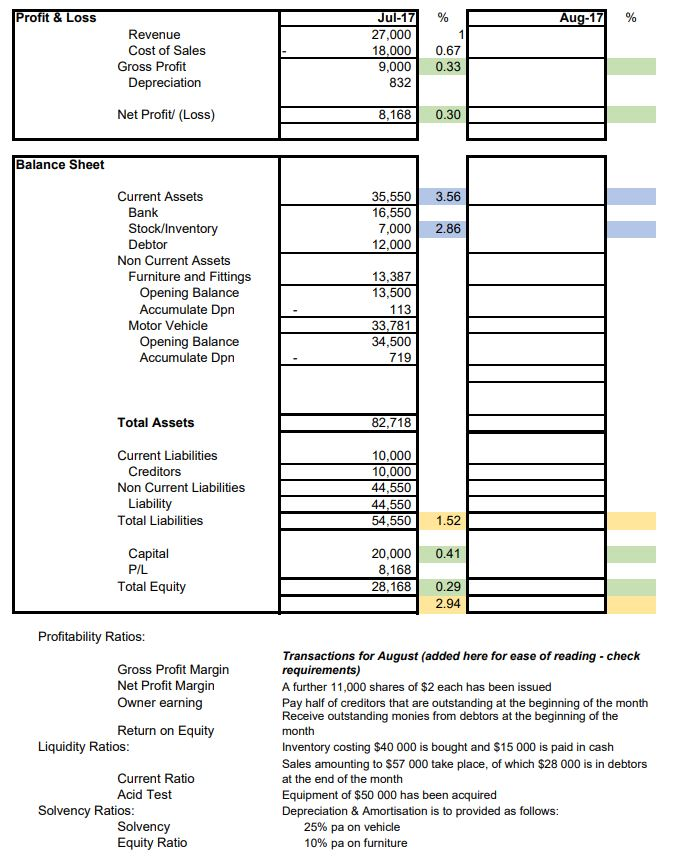

Suppose the retail chain estimates that the online platform will generate an additional $100,000 in annual revenue. The incremental cost of $20,000 seems justified given the potential benefits. Relevant costs (also called incremental costs) are incurred only when a particular activity has been initiated or increased.

It is usually made up of variable costs, which change in line with the volume of production. Incremental cost includes raw material inputs, direct labor cost for factory workers, and other variable overheads, such as power/energy and water usage cost. Suppose a firm has the opportunity to secure a special order if it offers a discounted price per unit. If managers calculate the incremental cost per unit, they might find it is $25 compared to an average cost of $40. However, if management offers a deeper price cut, it won’t cover the cost, and the firm will take a loss on the deal. Incremental cost is the total cost incurred due to an additional unit of product being produced.

Incremental and marginal costs

- A restaurant with a capacity of twenty-five people, as per local regulations, needs to incur construction costs to increase capacity for one additional person.

- It characterizes the added costs that might not exist if an extra unit was not produced.

- The first step in calculating the incremental cost is determining how many units you want to add to your normal production capacity.

- Firms often need to set special prices for sales promotions or one-time orders.

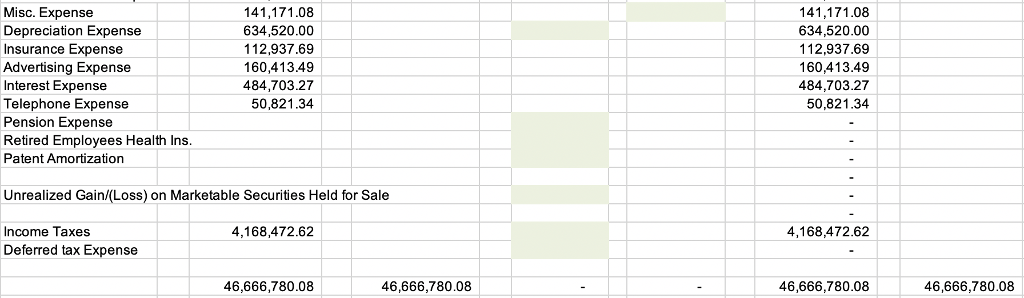

The formula is the difference in total cost divided by the number of additional units produced. Incremental cost specifically tells business owners about the worthiness of allocating additional resources for a new production volume. Economies of scale show that companies with efficient and high production capacity can lower their costs, but this is not always the case. Some ventures waste time and resources, and calculating the incremental cost versus projected sales at a particular volume avoids that.

Incremental cost is important because it affects product pricing decisions. If incremental cost leads to an increase in product cost per unit, a company may choose to raise product price to maintain its return on investment (ROI) and to increase profit. Conversely, if incremental cost leads to a decrease in product cost per unit, a company can choose to reduce product price and increase profit by selling more units. The reason why there’s a lower incremental cost per unit is due to certain costs, such as fixed costs remaining constant. Let’s say, as an example, that a company is considering increasing its production of goods but needs to understand the incremental costs involved. Below are the current production levels, as well as the added costs of the additional units.